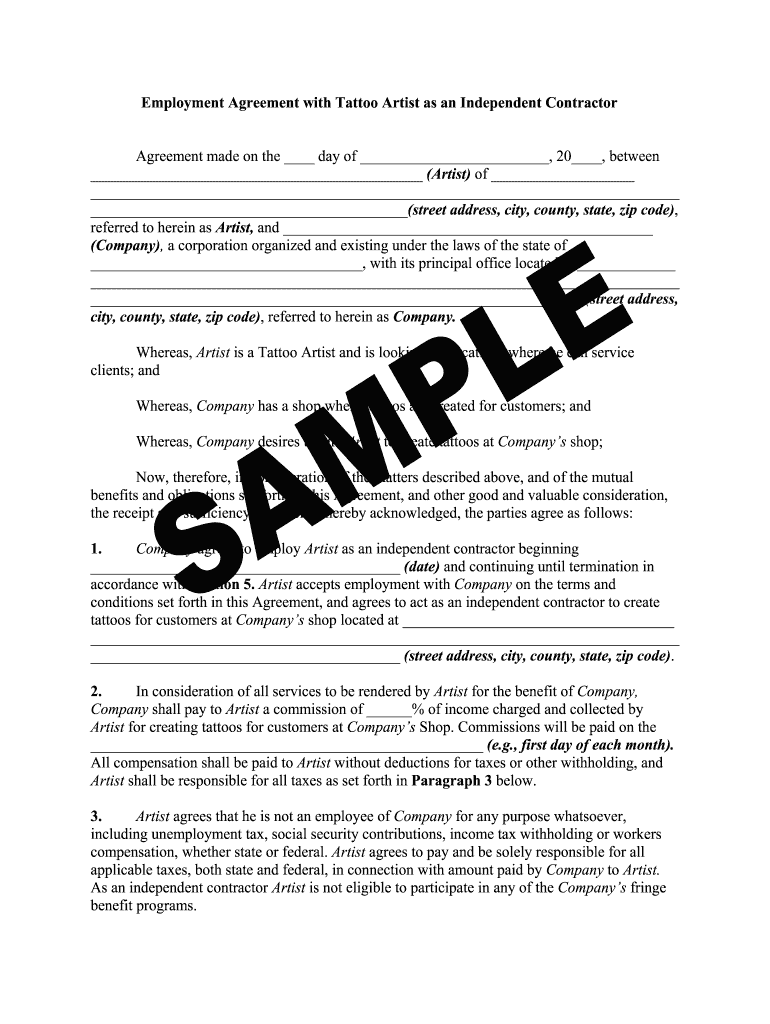

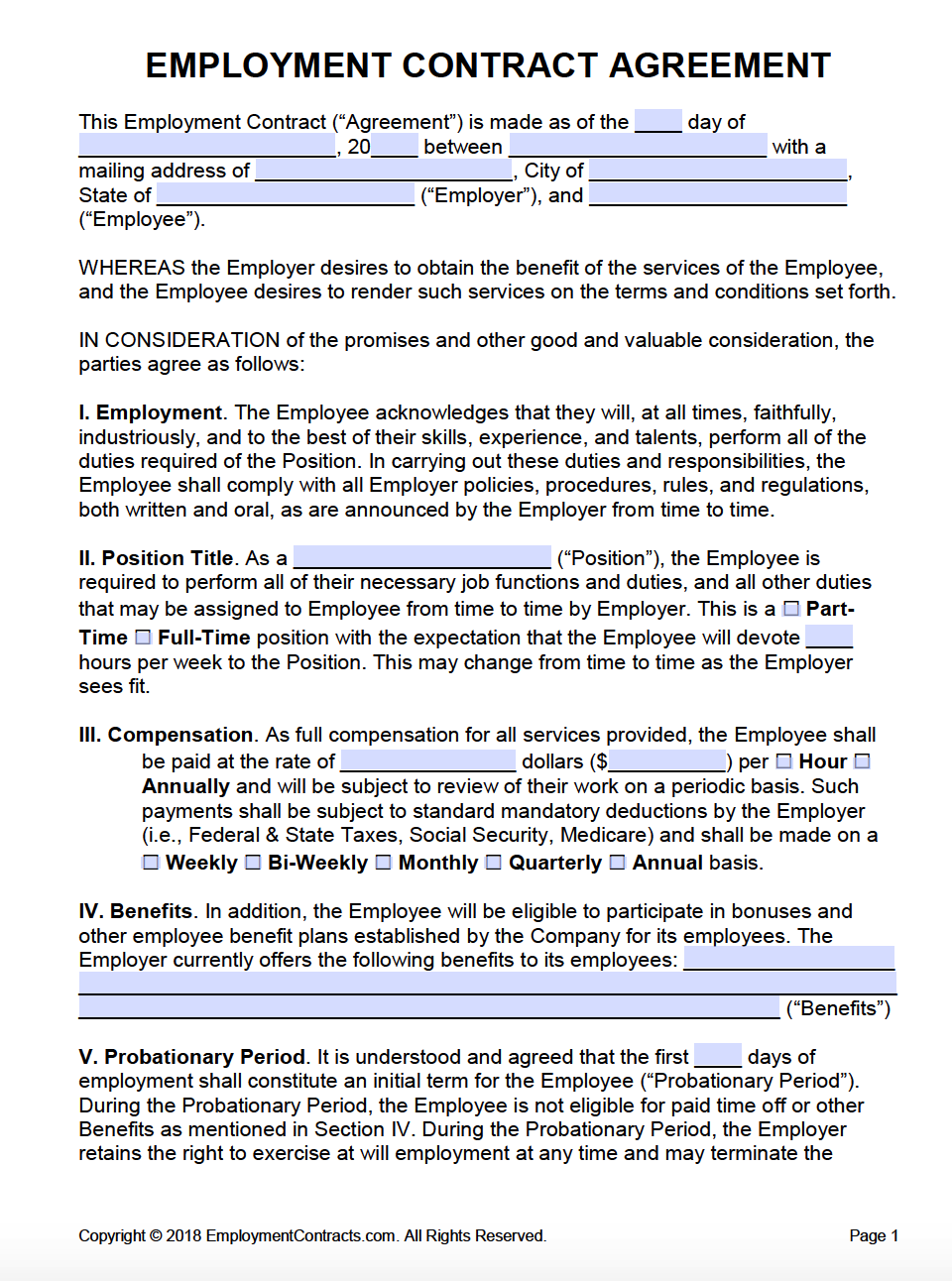

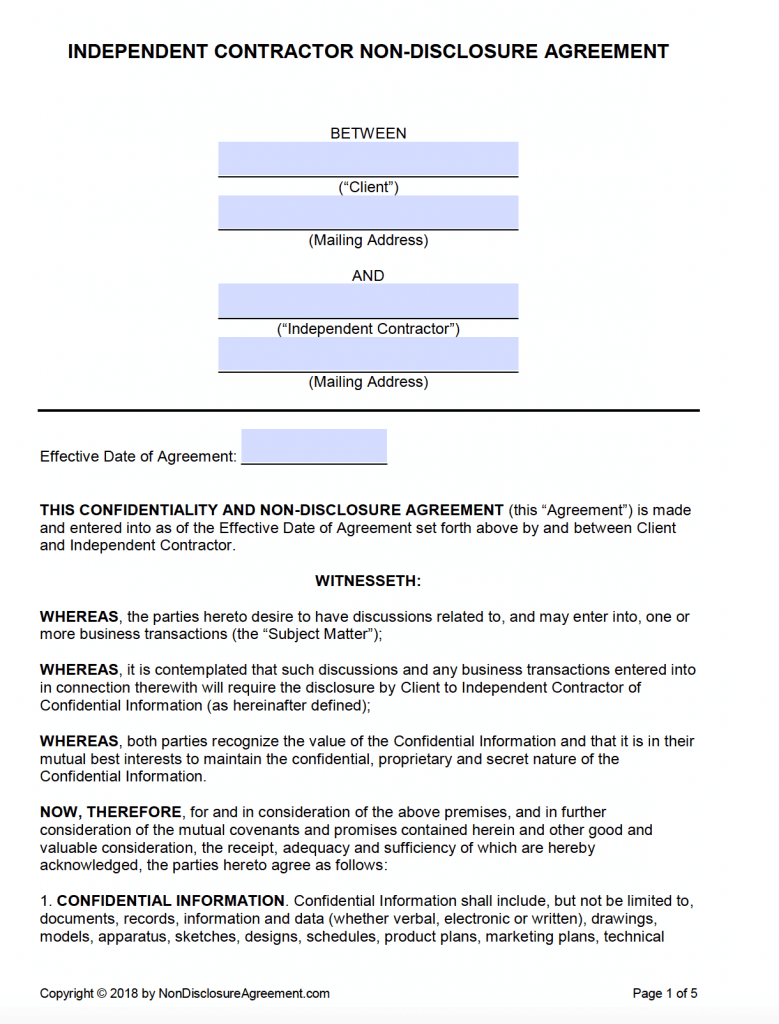

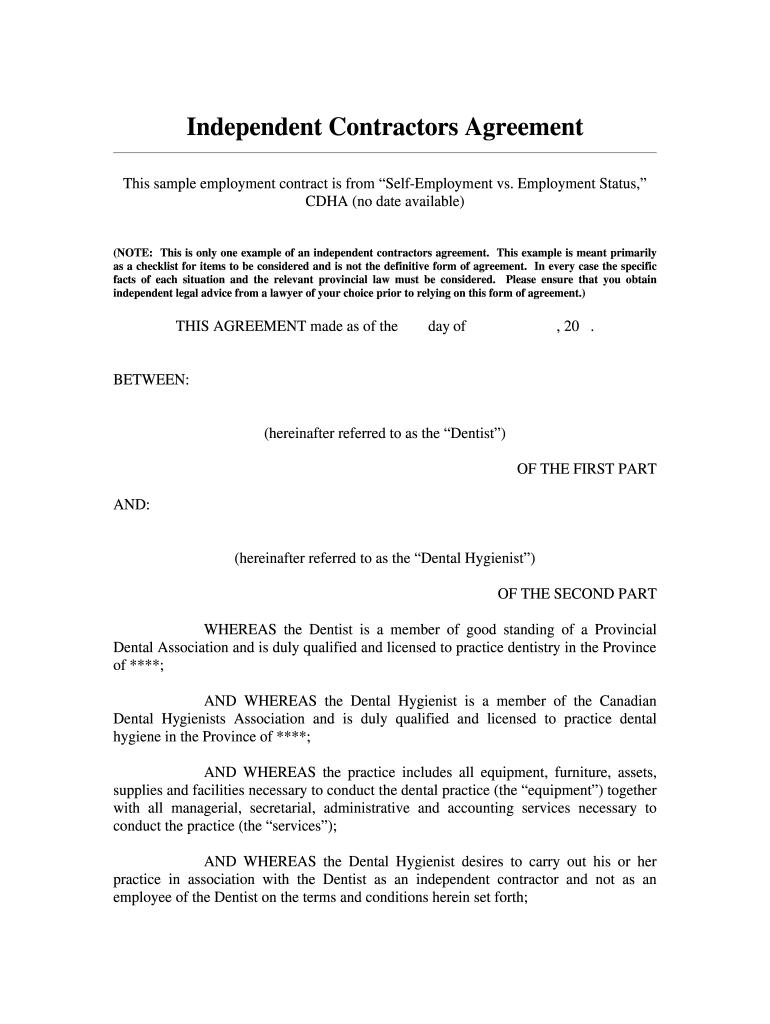

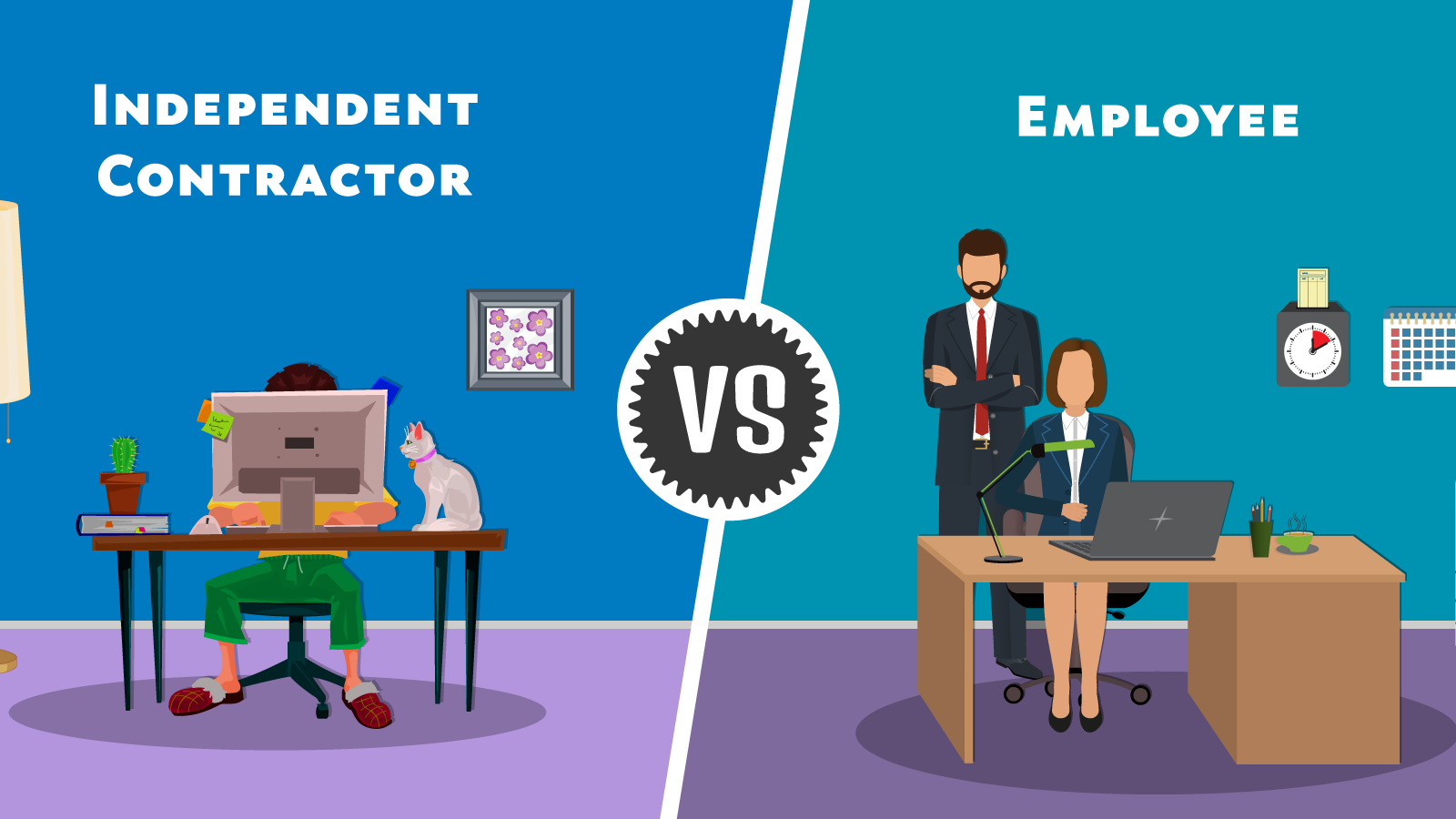

Independent Contractor Agreement Template An independent contractor agreement is a legal agreement between an independent contractor and their client Also called a 1099 agreement, or a business contract, this document details the services the contractor agrees to perform and the terms of the jobAn independent contractor agreement is a contract that documents the terms of a client's arrangement with a contractor This is also referred to as a freelance contract, a general contractor agreement, a subcontractor agreement, and a consulting services agreement, among other alternative names The earnings of a person who is working as an independent contractor are subject to SelfEmployment Tax If you are an independent contractor, you are selfemployed To find out what your tax obligations are, visit the SelfEmployed Tax Center You are not an independent contractor if you perform services that can be controlled by an employer (what will be done and

7 Tips For Managing Freelancers And Independent Contractors

Self employed 1099 contractor simple independent contractor agreement

Self employed 1099 contractor simple independent contractor agreement- An independent contractor is a selfemployed professional who works under contract for an individual or business, their client Unlike an employee, an independent contractor cannot be managed by the employer except within the context of their agreementHere's a simple rule If you work as an independent contractor, it's up to you to pay income and selfemployment taxes (Social Security and Medicare taxes) on the payments you receiveYou must also pay a 124% Social Security tax and 29% Medicare tax on such income

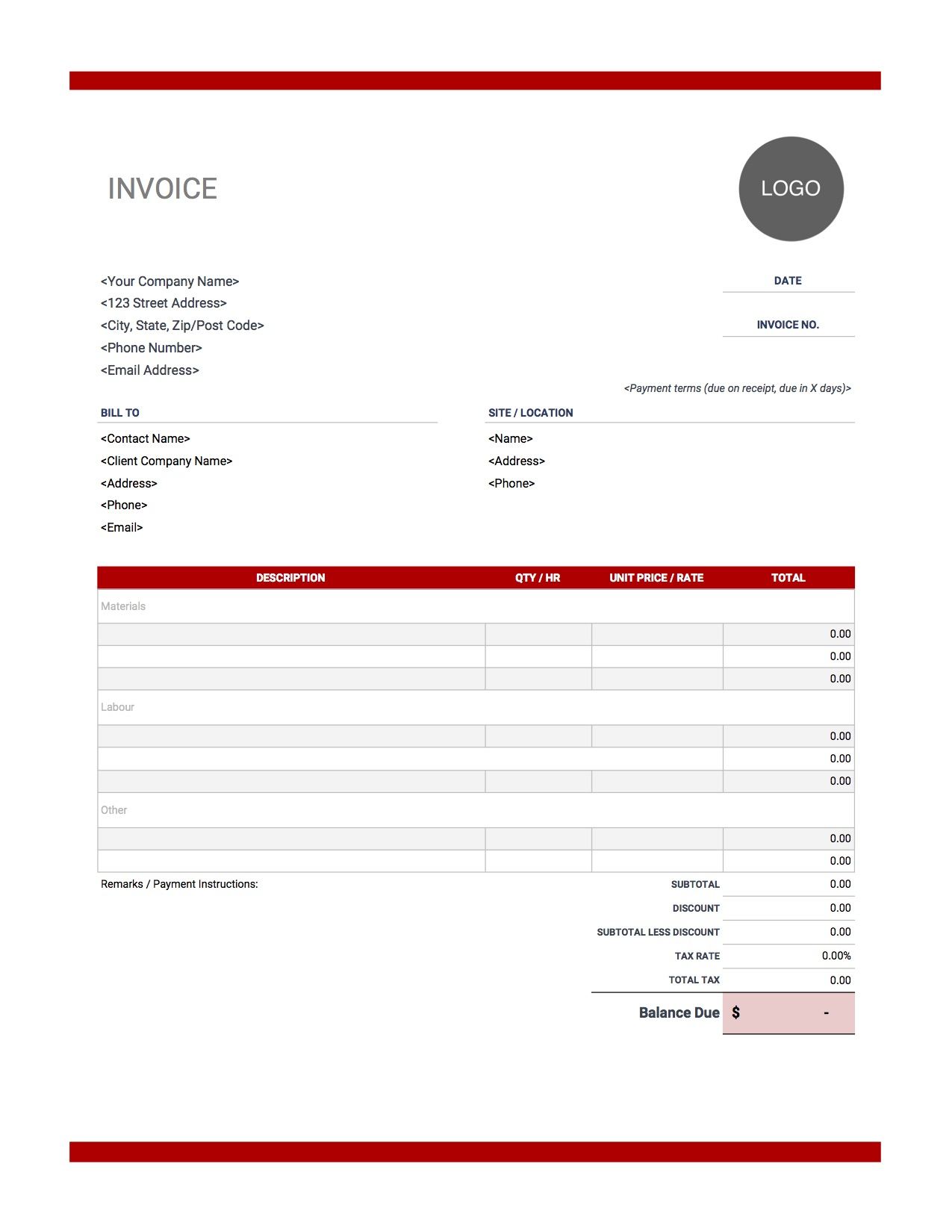

Independent Contractor 1099 Invoice Templates Pdf Word Excel

Independent Contractor status when engaging the services of an Individual, Sole guidelines for use independent contractor classification "It feels like a kick in the gut," she said The new rules allow sole proprietors, independent contractors and the selfemployed to use gross income rather than net profit when determining theMany people work as independent contractors in services to others While one person can be an independent contractor, so can a company For example, if you need to hire someone to paint your kitchen, that can be a selfemployed individual or a painting companyAn independent delivery driver contract is between a company seeking to hire an individual to deliver goods to customers The most common types are short to medium distance drivers for delivering goods for companies such as Amazon or for foodrelated businesses Depending on the agreement between the company and driver, a vehicle may or may not

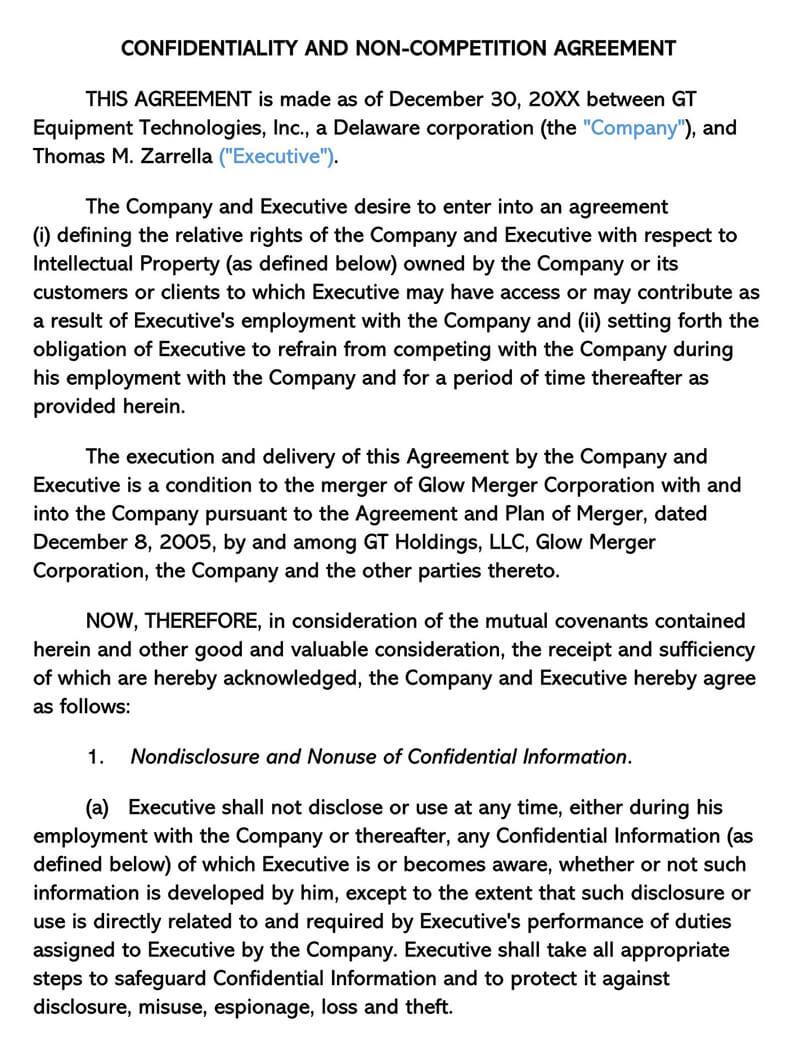

INDEPENDENT CONTRACTOR AGREEMENT and local tax laws for payment of income taxes and, if applicable, self employment taxes and any other taxes, contributions, payments, or premiums required by law Because Contractor is It is understood and agreed that HWS shall provide Contractor with a Form 1099 in accordance with applicable federalHiring an independent contractor is a great way to reduce or avoid payroll tax Independent contractors pay both employee and employer selfemployment income taxes, so you don't need to worry about paying any at all!NonCompete Clauses in a Contractor Agreement An independent contractor has their own business and offers its services for hire Unlike an employee, an independent contractor is selfemployed and must, on their own, pay selfemployment tax for

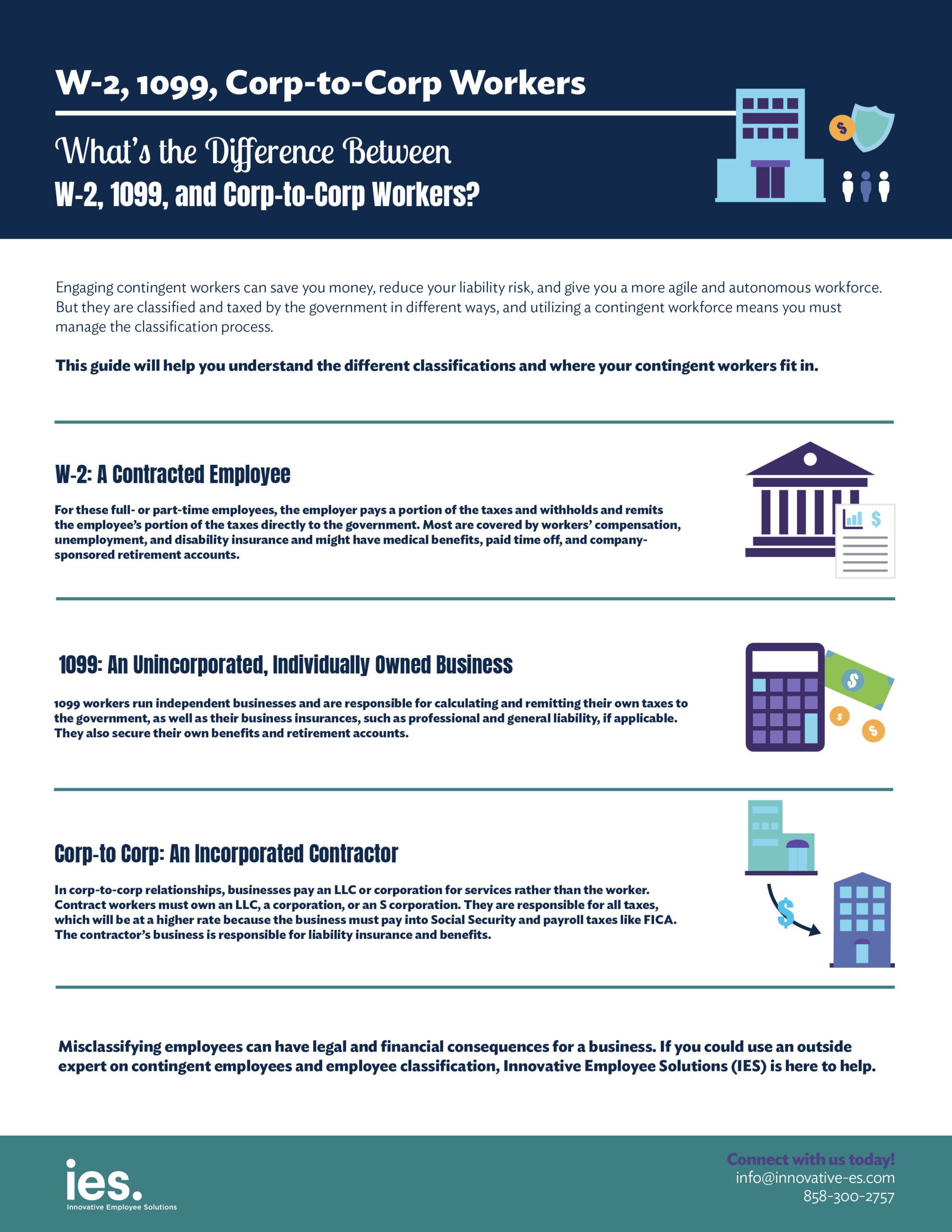

1099 workers are also ineligible for benefits like health insurance that your W2 employees enjoyEmploy the most complete legal library of forms US Legal Forms is the perfect platform for finding updated Sample SelfEmployed Independent Contractor Contract for specific job templates Our service provides a large number of legal forms drafted by certified legal professionals and categorized by state If payment for services you provided is listed on Form 1099NEC, Nonemployee Compensation, the payer is treating you as a selfemployed worker, also referred to as an independent contractor You don't necessarily have to have a business for payments for your services to be reported on Form 1099NEC

1

Free Independent Contractor Agreement Pdf Word

An independent contractor agreement is a contract between a nonemployee worker and an employer for work on an outsourced job or project Independent contractor agreements are also called 1099 agreements, freelance contracts, or subcontractor agreementsCover letter examples self employed the details of the work to be performed terms of the agreement deliverables compensation and any additional clauses Independent Contractor Agreement agreement rlIndependent Contractor Agreement forms are suitable for contract workers freelance consultants and 1099 contract workers Our simple The companies you work for are required to issue 1099 forms to detail how much you earned from them the previous year if earned more than a certain amount The earnings of a person who is working as an independent contractor are subject to the selfemployment tax

How To Apply For A Ppp Loan If You Re Self Employed Nav

2

An independent contractor may need to file a 1099MISC form with the IRS to report freelance earnings A company employing independent contractors, will need to complete a 1099MISC form if payments to individual contractors reach a threshold set by the IRSDefinition of a California 1099 Independent Contractor The term 1099 independent contractor refers to a person who provides goods or services to another but not as an employee The recipient of the services or products does not deduct your socialIndependent contractor agreements are easy to conclude and are a way to clearly outline the scope of work, payment timelines and timelines for a professional agreement Our proposals also contain a confidentiality agreement, insurance expectations and a compensation clause A selfemployed contractor is selfemployed

Independent Contractor 1099 Invoice Templates Pdf Word Excel

Independent Contractor Contract Template The Contract Shop

In addition to filing their usual personal tax return, independent contractors must file Form 1099 when they provide their annual declaration This is necessary for selfemployed workers as they must pay an additional 15% tax for their Social Security and Medicare needs 5 Reasons Your Independent Contractor Pet Sitters May Be Employees For a growing Pet Sitting or Dog Walking business — the decision to use Independent Contractors vs Employees is one of the earliest, hardest, and most important choices you make1099 vs W2 How Independent Contractors and Employees Differ An employee performs work for you under your direct or indirect supervision, during hours that you specify and conditions you control You also withhold payroll taxes from the wages you pay him or her

1099 Workers Vs W 2 Employees In California A Legal Guide 21

How U S Companies Harm Workers By Making Them Independent Contractors Equitable Growth

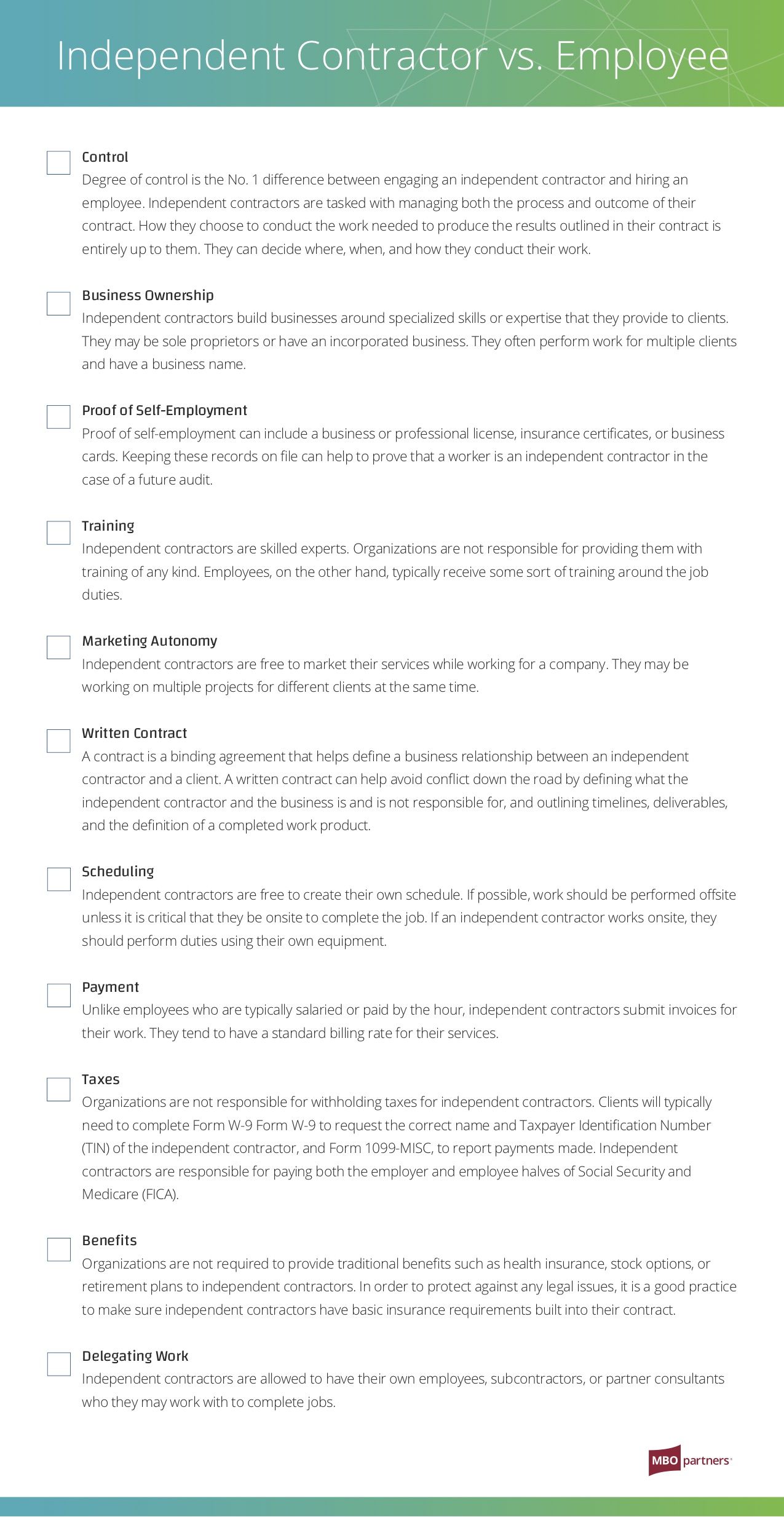

A business owner needs an Independent Contractor Agreement for several reasons Setting Expectations An Independent Contractor Agreement explicitly sets out the expectations and parameters of the work to be done, the compensation, and the nature of the relationship itselfIt is a clearcut explanation of the expected workflow, how communication will be handled, and howMortgage Loan Originator Independent Contractor Fill out, securely sign, print or email your Independent contractor loan originator agreement Mortgage Giver instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!INDEPENDENT CONTRACTORS IRS FACTOR TEST An independent contractor is a worker who individually contracts with an employer to provide specialized or requested services on an asneeded or project basis This individual is free from control and direction of the performance of their work, and the individual is customarily engaged

Tips On Proving Income When Self Employed

2

CDET Example of Contract for Selfemployed or Freelance Staff for Recognised Awards EXAMPLE CONTRACT FOR SELFEMPLOYED or FREELANCE SERVICES This is an example of a contract for selfemployed or freelance services to use when engaging a genuinely selfemployed freelancer, consultant or sole traderFill out and download SelfEmployed Independent Contractor Employment Agreement General from SellMyForms SellMyForms is an easytouse platform that allows you to quickly find a readymade document template, edit it and save for further useSelf Employed Contractor Agreement Template Uk Use one of the free model templates for independent contractors to create a simple contract contract that covers your work as a freelancer An independent contractor may be required to submit a Form 1099MISC to the IRS to report professional income A company that employs independent

Lovely Independent Contractor Agreement Arizona Models Form Ideas

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Since the Federal threshold for issuing a 1099K is $600, Etsy does not have to distribute to sellers a 1099 under $600 of transactions Taxes You Will Need To File As A Seller On Etsy As an Etsy seller, if you earn $400 or more, you will be responsible to pay selfemployment tax (Social Security and Medicare) as well as income tax You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting filesIf you paid someone who is not your employee, such as a subcontractor, attorney or accountant $600 or more for services provided during the year, a Form 1099NEC needs to be completed, and a copy of 1099NEC must be provided to the independent contractor by January 31 of the year following payment

Independent Contractor Agreement Form California Elegant Independent Contractor Tax Forms Sample 1099 Form Beautiful Luxury Models Form Ideas

1099 Misc Form Fillable Printable Download Free Instructions

Client will not require Contractor to rent or purchase any equipment, product, or service as a condition of entering into this Agreement 5 Independent Contractor Status Contractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, or shall be deemed, Client's employeesThe Salon Independent Contractor Agreement establishes a binding arrangement between a hair stylist or barber and a salon company In most cases, the hair stylist acts as an independent contractor that is responsible for obtaining their own clients and customers Therefore, the salon company will generally provide the booth, most of the equipment, and training in exchange for aAdhere to the instructions below to make your account and find the Arizona SelfEmployed Independent Contractor Agreement template to deal with your situation Utilize the Preview solution or browse the file information (if available) to make sure that the

3

2

Generally, if you're an independent contractor you're considered selfemployed and should report your income (nonemployee compensation) on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) Most selfemployed individuals will need to pay selfemployment tax (comprised of social security and Medicare taxes) if theirTax Worksheet for Selfemployed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099MISC with box 7 income listed Try your best to fill this out If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate Independent Contractor Income Independent contractor income is compensation you receive for doing work or providing services as a selfemployed individual, not as an employee If you are selfemployed and an independent contractor, your compensation is reported on one of the many 1099 Forms (along with rents, royalties, and other types of income)

How To Apply For Unemployment As An Independent Contractor Money

2

Additionally, an independent contractor has his or her own business and provides goods or services to the host business Therefore, noncompete agreements are often unenforceable against independent contractors because this would cause the business to forfeit its own profit and prosperity in simple exchange for a portion of its businessDescription Employment Agreement Work This form is an agreement between an employer and an independent contractor The contractor agrees to render certain services for the benefit of the employer The document provides that time is of the essence and the agreement consitutes the entire contract between the partiesAnd the payment of all taxes incurred related to or while performing the Services under this Agreement, including all applicable income taxes and, if the Contractor is not a corporation, all applicable selfemployment taxes Upon demand, the Contractor shall provide the Client with proof that such payments have been made

What Forms Do You Need To Hire An Independent Contractor Workest

:max_bytes(150000):strip_icc()/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

And Independent Contractor agree as follows 1 Work Status The Employer hereby employs the Independent Contractor as an independent contractor, and the Independent Contractor hereby accepts employment 2 Start Date The term of this Agreement shall commence on _____, ____ Either party may, without cause, terminate this Agreement by giving ____ day(s') written notice to the other 3 Services Provided The Employer shall pay to the Independent Contractor

2

1099 Misc Instructions And How To File Square

Independent Contractor 1099 Invoice Templates Pdf Word Excel

Tattoo Shop Artist Agreement Fill Online Printable Fillable Blank Pdffiller

Hiring Guide For 1099 Independent Contractors Legalities Forms Taxes Exaktime

Free Contractor Invoice Template Independent Contractor Invoice Bonsai

Truck Driver Contract Agreement Free Printable Documents Contract Agreement Letter Sample Contract

Read Consultant Independent Contractor Agreements Online By Stephen Fishman Books

What Do We Know About Gig Work In California An Analysis Of Independent Contracting Uc Berkeley Labor Center

W 9 Vs 1099 Understanding The Difference

2

Free Independent Contractor Agreement Templates Pdf Word Eforms

Use Our Compliance Checklist To Minimize Contractor Risk Mbo Partners

Self Employment Contract Sample Employment Ihtf

Form 1099 Misc For Independent Consultants 6 Step Guide

Free Employment Agreements Contracts Pdf Word

How To Write An Independent Contractor Agreement Mbo Partners

Free One 1 Page Independent Contractor Agreement Pdf Word Eforms

7 Tips For Managing Freelancers And Independent Contractors

What Can Independent Contractors Deduct

How To Legally Hire Independent Contractors Updated In 18

1099 Workers Vs W 2 Employees In California A Legal Guide 21

Independent Contractor 1099 Invoice Templates Pdf Word Excel

Solved How To Prepare 1099 Miscs For Independent Contractors In Quickbooks Online Plus

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

Form 1099 Nec Form Pros

Independent Contractor Contract Template The Contract Shop

Free Independent Contractor Non Disclosure Agreement Nda Pdf Word Docx

Independent Contractor Agreement Free Contractor Templates 360 Legal Forms

Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov

Top 25 1099 Deductions For Independent Contractors

Self Contract Template Fill Online Printable Fillable Blank Pdffiller

Instant Form 1099 Generator Create 1099 Easily Form Pros

Do Contract Employees Get Paid Overtime

Wrongful Termination For 1099 Independent Contractors Workers Compensation Attorney

/GettyImages-481518099-5c5c983fc9e77c00010a47cc.jpg)

What Is An Independent Contractor

Independent Contractor Taxes Things To Know Credit Karma Tax

2

Free Non Compete Agreement Templates Employee Contractor

2

Employee Versus Independent Contractor The Cpa Journal

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

All You Need To Know When Hiring Foreign Independent Contractors

Truck Driver Contract Agreement Free Printable Documents Contract Agreement Truck Driver Independent Contractor

3

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

2

Independent Contractor Profit And Loss Statement The Spreadsheet Page

Michigan Unemployment Self Employed 1099 Contractors Gig Workers Can Apply Today

/documents-when-hiring-a-contract-worker-398608_final-c7b9e3e0f1704d388f723fe60239b079.png)

3 Documents You Need When Hiring A Contract Worker

Why You Need To Understand The Difference Between Independent Contractor Self Employed And Employee Nurse Practitioners In Business

50 Free Independent Contractor Agreement Forms Templates

Irs Form 1099 Nec And 1099 Misc Rules And Exceptions

Independent Contractor Taxes Guide 21

2

What Is The 1099 Form For Small Businesses A Quick Guide

Protecting Rights To Ip As A Freelance Worker Or Independent Contractor

Free Georgia Independent Contractor Agreement Word Pdf Eforms

Employee Versus Independent Contractor The Cpa Journal

Gig Economy Improving The Federal Tax System For Gig Economy Work

Hiring Independent Contractors Vs Full Time Employees Pilot Blog

Free Independent Contractor Agreement Template Download Wise

3

How To File Taxes As An Independent Contractors H R Block

2

50 Free Independent Contractor Agreement Forms Templates

Free Independent Contractor Agreement Template Download Wise

2

Contractor Profit And Loss Template Simple Business Guru

Contractor Invoice Templates Free Download Invoice Simple

Independent Contractor Vs Employee What S The Difference Bench Accounting

1099 Misc Form Fillable Printable Download Free Instructions

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

Paystub Generator For Self Employed Fill Online Printable Fillable Blank Pdffiller

Independent Contractor Vs Employee Explained California Law 21

What S The Difference Between W 2 1099 And Corp To Corp Workers

Self Employment 1099s And The Paycheck Protection Program Bench Accounting

Best Practices For Hiring Self Storage Service Contractors And Vendors Inside Self Storage

Free Independent Contractor Agreement Template Download Wise

Gig Economy Improving The Federal Tax System For Gig Economy Work

Free Independent Contractor Agreement Free To Print Save Download

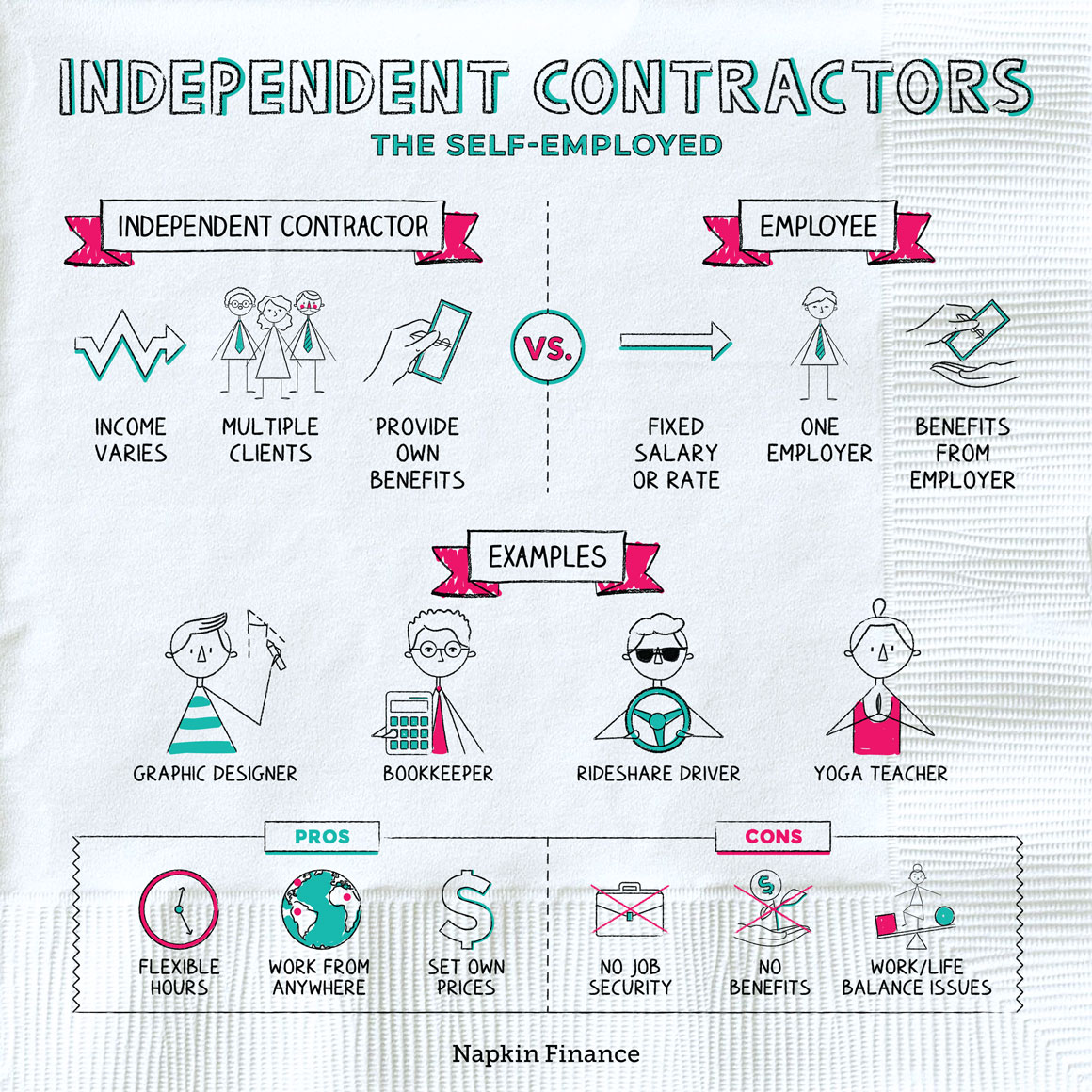

What Is An Independent Contractor Napkin Finance Has Your Answer

Independent Contractor Profit And Loss Statement The Spreadsheet Page

0 件のコメント:

コメントを投稿